February 27, 2026

Quote of the Day

I believe that imagination is stronger than knowledge. That myth is more potent than history. That dreams are more powerful than facts. That hope always triumphs over experience. That laughter is the only cure for grief. And I believe that love is stronger than death.

~ Robert Fulghum

This Day in History

February 27, 1932: Elizabeth Taylor is born. Dame Elizabeth Rosemond Taylor was a British and American actress. She began her career as a child actress in the early 1940s and was one of the most popular stars of classical Hollywood cinema in the 1950s. She then became the world’s highest-paid movie star in the 1960s, remaining a well-known public figure for the rest of her life. In 1999, the American Film Institute ranked her seventh on its greatest female screen legends list.

Her best known role was in Cleopatra (1963), which received multiple Oscar nominations and a lavish production budget and schedule. Taylor’s acting career began to decline in the late 1960s, although she continued starring in films until the mid-1970s. Taylor married her Cleopatra co-star Richard Burton. There was a public scandal, given his marriage at the time of filming. Dubbed “Liz and Dick” by the media, they starred in 11 films together, including The V.I.P.s (1963), The Sandpiper (1965), The Taming of the Shrew (1967), and Who’s Afraid of Virginia Woolf? (1966). Taylor received the best reviews of her career for Woolf, winning her second Academy Award and several other awards for her performance.

She and Burton divorced in 1974 but reconciled soon after, remarrying in 1975. The second marriage ended in divorce in 1976, after which she focused on supporting the career of her sixth husband, United States Senator John Warner. In the 1980s, she acted in her first substantial stage roles and in several television films and series. She became the second celebrity to launch a perfume brand after Sophia Loren. Taylor was one of the first celebrities to take part in HIV/AIDS activism. She co-founded the American Foundation for AIDS Research in 1985 and the Elizabeth Taylor AIDS Foundation in 1991. From the early 1990s until her death, she dedicated her time to philanthropy, for which she received several accolades, including the Presidential Citizens Medal in 2001.

Ojai Weather

Mostly sunny – High 87 / 54

Total rainfall for the season – 26.67

Lake Casitas water capacity – 100%

Friday, February 27, 2026

1:05 p.m.

There is one new listing on the market:

1157 Woodland Avenue – $1,055,000

Just a note; interest rates for a 30-year conventional mortgage sneaked/snuck down to 5.99% this morning…have a great weekend!

Pic of the Day

Another vintage Ojai photo – this one of Zaidee Soule (bottom right) and her classmates, circa 1893

Thursday, February 26, 2026

11:30 a.m.

There are four new listings on the market:

901 Grandview Avenue – $1,360,000

1519 Ayers Avenue – $4,700,000

10829 Oak Knoll Road – $6,995,000

1273 S. Rice Road #55 – $345,000

Here’s a quick mortgage rate update (we’re so close to getting into the 5’s for 30-yr conventional loans):

30-yr fixed: 6.00%

15-yr fixed: 5.61%

30-yr Jumbo: 6.27%

30-yr FHA: 5.64%

30-yr VA: 5.65%

Pic of the Day

Tuesday, February 24, 2026

9:00 a.m.

There are two new(ish) listings on the market:

1130 Rancho Drive – $3,000,000

10542 Creek Road – $649,000

(This land parcel was split from the residential home listing at the same address. Technically, this is partially “new.”)

Recently cancelled, withdrawn, or expired listings – back on the market as “new:”

- 336 El Conejo Drive – $1,079,000 (this had recently been cancelled on 2/16).

Pic of the Day

Friday, February 20, 2026

1:15 p.m.

Three new listings have come to the market since Wednesday:

75 Maxine Avenue – $899,000

207 S. Blanche Street – $1,649,000

1202 Loma Drive #46 – $260,000

Recently cancelled, withdrawn, or expired listings – back on the market as “new:”

- 1225 Shippee Lane – $14,800,000 (this had recently been cancelled on 2/19).

We’ll be holding an open house on our listing at 12752 Sisar Road tomorrow from 1:00 to 4:00. Come by to check it out!

Pic of the Day

Wednesday, February 18, 2026

7:10 a.m.

There is a new “coming soon” listing on the market:

7500-1 Sulphur Mountain Road – $1,850,000 (coming soon, 2/19)

Pic of the Day

Tuesday, February 17, 2026

8:40 a.m.

There are no new listings for today.

Pic of the Day

Monday, February 16, 2026

8:15 a.m.

There are two new listings on the market:

203 N. Carrillo Road #8 – $759,000

828 Fordyce Rd./2561 Grand Ave. – $10,999,000

Recently cancelled, withdrawn, or expired listings – back on the market as “new:”

- 1920 Tiara Drive – $1,450,000 (this had recently been cancelled 1/28. It is now a pending sale/under contract).

The website had several issues last week with the hosting/server (especially Friday) – it should be fixed from today going forward.

Pic of the Day

Friday, February 13, 2026

8:15 a.m.

Three new or “coming soon” listings have come to the market since Tuesday:

1318 La Paz Drive – $1,369,000

910 Mercer Avenue – $1,060,000 (coming soon, 2/18)

1210 S. La Luna Avenue – $2,550,000 (coming soon, 2/17)

Recently cancelled, expired, or withdrawn listings – back on the market as “new:”

- 1131 Rancho Drive – $4,250,000 (this had recently expired on 1/9).

We’ll be holding our listing at 12752 Sisar Road in upper Ojai open tomorrow (Saturday) from 1:00 to 4:00. You can catch a sneak peek of it today from 9:30 to noon as well. This really is an amazingly updated cabin – located close to the Sisar Trail. Here’s a 3-minute video I put together recently (click on the photo below). Expand the video to full screen so that you can read the descriptions without the video overlay covering them. I hope you’ll enjoy it. Have a great weekend!

Pic of the Day

Tuesday, February 10, 2026

2:25 p.m.

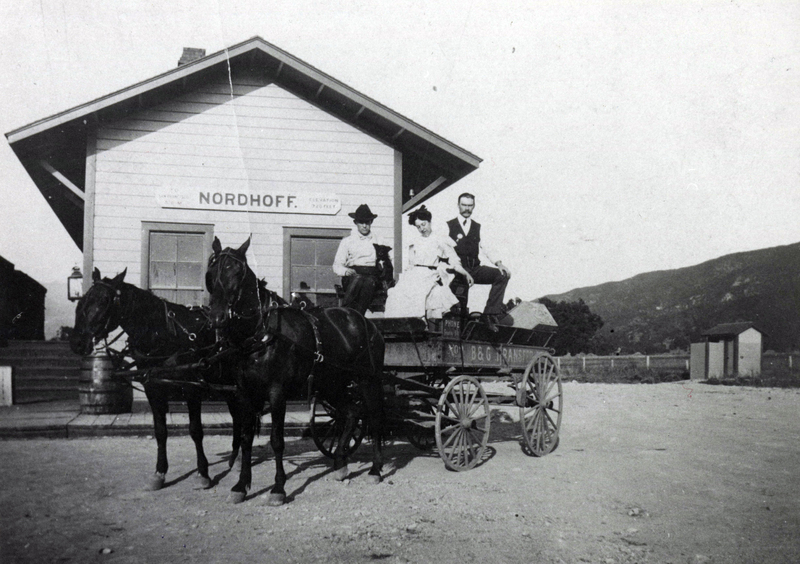

No new listings have come to the market since last Friday. Here are a couple Pic(s) of the Day for you:

Yet another cool vintage Ojai photo – the Nordhoff Taxi service (B&G Transfer), circa 1900

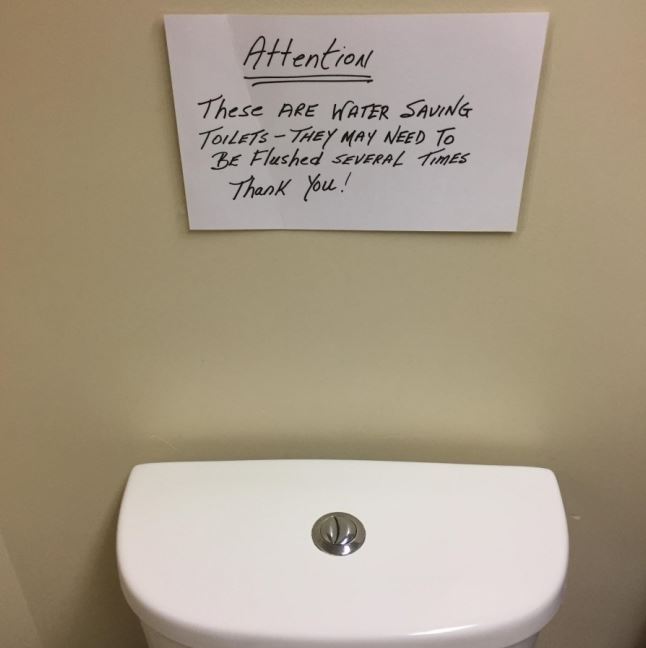

And the usual daily nonsense below:

Friday, February 6, 2026

1:50 p.m.

There are two new listings on the market:

385 Sunset Avenue – $795,000

13202 Ojai Road – $8,880,000

(Although this property shows as a “Santa Paula” address, I’m including it because other properties

in this area have been listed as being located in Ojai – and this is close enough and certainly qualifies.)

Recently cancelled, withdrawn, or expired listings – back on the market as “new:”

- 125 N. Alvarado Street – $875,000 (this had recently been cancelled on 2/4).

Pic of the Day

Thursday, February 5, 2026

1:45 p.m.

There are two new listings on the market:

2170 Ladera Road – $1,749,000

1309 Gregory Street – $849,000

Pic of the Day

Wednesday, February 4, 2026

12:05 p.m.

No new listings have come to the market today.

Recently cancelled, withdrawn, or expired listings – back on the market as “new:”

- 741 Saddle Lane – $8,230,000 (this had recently expired on 12/14/25).

Pic of the Day

Tuesday, February 3, 2026

11:50 a.m.

One new listing has come to the market since last Friday:

543 Good Hope Street – $849,000

Pic of the Day

Click here for archived January, 2026 posts

![]()